Difference between revisions of "Prevailing Wage"

(→Additional Information: Added in category information) |

m |

||

| Line 573: | Line 573: | ||

[[Category:Construction Manual]] | [[Category:Construction Manual]] | ||

[[category:Division 1]] | [[category:Division 1]] | ||

| + | [[category:Division 1 Supplemental Information]] | ||

[[category:Section 107]] | [[category:Section 107]] | ||

Revision as of 15:07, 14 July 2021

Prevailing Wage

The Davis-Bacon Related Acts (DBRA) attach prevailing wage requirements to public works construction contracts financed in whole or in part with federal grants, loans, guarantees, insurance, and/or federal funding assistance. The DBRA requirements apply to Federal-aid contracts in excess of $2,000 for the construction, alteration, and/or repair of public buildings or public works. Contractors and subcontractors employing laborers and mechanics directly upon the site of work must compensate those workers at predetermined minimum wage rates, normally expressed in a basic hourly rate and fringe benefit value. These wage rates are compiled into a wage determination and included in the construction bid documents. The terms “laborer” and “mechanic” generally include workers whose duties are manual or physical in nature, workers who use tools, and individuals performing the work of a trade. The terms do not apply to workers whose duties are primarily administrative, executive, professional, or clerical, rather than manual. The required contract clauses exerting prevailing wage coverage as well as other federal contracting requirements are found in Form FHWA-1273, which is also included in the bid documents for Federal-aid contracts.

The wage determination incorporated into the bid documents contains a list of construction occupations with corresponding basic hourly rate and fringe benefit values. The sum of these two values represents the minimum “prevailing wage” for a given occupation that must be met or exceeded to comply with the requirements. A contractor or subcontractor performing work subject to a DBRA wage determination may satisfy their minimum wage obligation by:

- Paying the total rate in cash

- Making payments or incurring costs to provide bona fide fringe benefits

- Or, a combination of hourly wages and “bona fide” fringe benefits.

- Examples of “bona fide” fringe benefits:

- Defrayment of training and apprenticeship costs

- Pension or 401(k) contributions

- Paid time off including vacation, holiday, holiday, sick leave, etc.

- Life insurance

- Health insurance

- Disability insurance

- Supplemental unemployment benefit programs

- Others as approved by the Secretary of Labor.

- Examples of things that are NOT “bona fide” fringe benefits:

- Company vehicle (including fuel allowance)

- Paid Lodging

- Tools or equipment to perform work

- Cell Phones

- Loan Payments

- Uniforms

- Per diem

- Safety Equipment

- Bonuses

- Any deduction made in compliance with the requirements of Federal, State, or local law such as Federal or State income taxes, social security etc.

If there are any questions on the eligibility of a fringe benefit listed on the contractor’s breakdown, contact the Construction Field Services (CFS) Division’s Prevailing Wage Compliance Specialist.

Contractor Responsibilities

The prime contractor is responsible for all subcontractor and lower-tier subcontractor compliance with the requirements for prevailing wage. The term subcontractor includes any company with which the prime contractor has entered into a contractual agreement to work on the project. The prime contractor and subcontractors are individually liable for the payment of prevailing wage rates to their employees. The prime contractor is also liable for the payment of prevailing wages not paid by their subcontractors. In order to comply with these requirements, the prime contractor must:

- Advise all subcontractors of the requirement to pay prevailing wage prior to the commencement of work.

- Ensure workers are made available and participate in wage rate interviews.

- Submit all required weekly certified payrolls for themselves, each subcontractor, and each lower-tiered subcontractor to the Project Engineer.

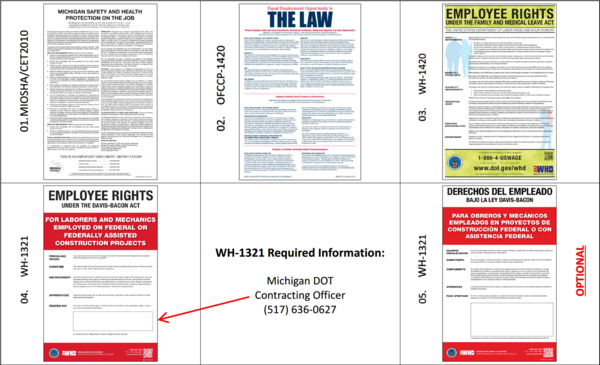

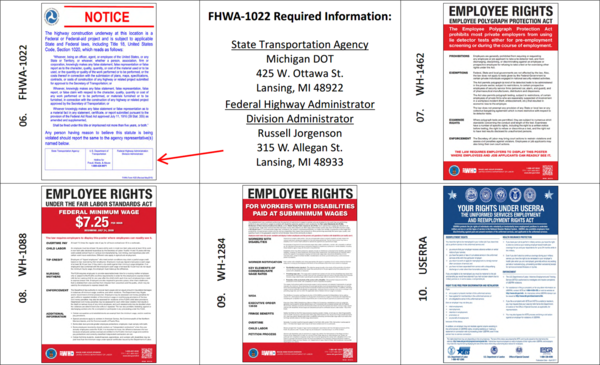

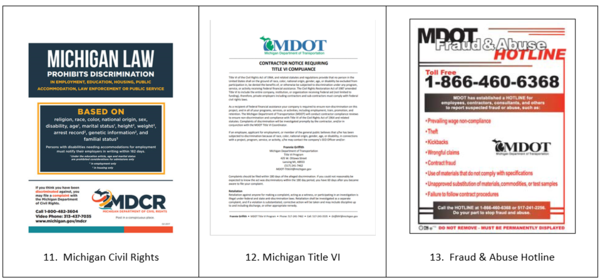

- Display all labor compliance posters and wage determination(s) on the jobsite.

Certified payroll reports must be submitted to the contract agency within a three-week grace period. The three-week period will allow for processing and review of the certified payroll reports by the prime contractor. If a contractor is working on a project consistently certified payroll reports will be submitted on a weekly basis thereafter.

Projects less than 75 calendar days in duration are considered short duration projects. The grace period between when work is performed and when payroll is due to the agency is reduced from three weeks to two weeks. The reduced submittal duration is intended to ensure that compliance is achieved throughout the working life of the contract.

In addition, the first weekly certified payroll must also include:

- A breakdown of hourly bona fide benefits payments made on behalf of each worker, or work classification, where applicable, and program administrator contact information.

- Identification of trainees and apprentices, and program levels.

These requirements are supplemental to all other required contract provisions.

Prevailing Wage Discussion at the Preconstruction Meeting

The following items should be discussed at the preconstruction meeting to establish the expectations of the owner (Engineer) for the contractor with regards to prevailing wage compliance during the work on the contract:

- The Wage Rate Decision(s) to be used when there are multiple decisions in the contract.

- The wage classifications to be used when there are apparent overlaps in classification duties and rates (Highway, Open Cut, Underground etc.).

- Submittal of certified payrolls through the prime contractor.

- Prime contractor’s responsibility for prevailing wage compliance for all contractors on the project.

- Jobsite posting requirements.

- Wage Rate Interview process and availability of employees for interviews.

- Payroll submission time frames.

- The consequences of delinquent and deficient certified payrolls.

- Other topics as needed.

Definition of Site of Work

The “site of work” is the physical place or places where the building or work called for in the contract will remain and any other site where a significant portion of the building or work is constructed, provided that such site is established specifically for the performance of the contract or project. (29 CFR 5.2). In the case of larger contracts, such as airports and highways, the site of the work is necessarily more extensive and may include the whole area in which the construction activity will take place. The site of work also includes batch plants, borrow pits, job headquarters, tool yards, etc., provided they are established for and dedicated exclusively, or nearly so, to the project, and are adjacent or virtually adjacent to the site of work.

The following locations are specifically excluded from the site of work definition:

- Permanent home offices, branch plant establishments, fabrication plants, tool yards, etc., of a contractor or subcontractor whose location and continuance in operation are determined wholly without regard to a particular federal or federally assisted project. In other words, if it is a permanent site that is not dedicated to the job, it is not within the site of work definition.

- Fabrication plants, batch plants, borrow pits, job headquarters, tool yards, etc., of a commercial or material supplier that are established by a supplier of materials for the project before opening of bids, and not on the site of the work, even where such operations for a period of time may be dedicated exclusively, or nearly so, to the performance of a contract.

Jobsite Postings

All required posters and information must be displayed at all times by the Contractor on the site of work in a prominent area that it easily seen and accessible. Jobsite poster compliance will be assessed using the MDOT Jobsite Poster Inspection Checklist (MDOT Form 1967). The first scheduled payment for Mobilization, Max (dollar) will not occur until the Engineer has verified and documented the postings of required labor compliance posters and the project specific prevailing wage rates. If construction operations span multiple years, the Engineer or their representative is responsible to inspect the postings each year in which construction work is performed prior to the commencement of work. A Jobsite Poster Inspection Checklist must be completed for each year’s inspection. Some projects may be inherently mobile in nature and not conducive to the establishment of a jobsite poster board (i.e. region-wide pavement markings or crack sealing). Questions concerning postings for these types of projects should be directed to the CFS Prevailing Wage Compliance Specialist.

- Jobsite Poster Fig. 1

- Jobsite Poster Fig. 2

- Jobsite Poster Fig. 3

NOTES:

- For current list of job site posters including revisions please visit the FHWA and USDOL websites.

- The title VI contact information should be as follows:

- Orlando T. Curry, MSA

- MDOT Title VI Program

- Michigan Department of Transportation

- 425 W. Ottawa Street

- Lansing, Michigan 48933

- Phone: 517-241-7462

- MDOT-TitleVI@michigan.gov

- Posters in Languages other than English are not required but are encouraged.

Certified Payrolls

Contractors must electronically submit weekly, for each week in which contract work is performed, all certified payrolls to the Engineer on federal-aid construction contracts. The prime contractor is responsible for the submission of copies of payroll reports completed by their subcontractors. Certified payroll must be submitted anytime construction work involving the employment of laborers and mechanics occurs regardless of contractual relationship to the construction project (i.e., subcontract, purchase order, invoice, etc.).

Submittal Requirements

The first certified payroll must be received by the Engineer within three weeks from the start of the work for the prime contractor and/or subcontractor(s). The three-week period will allow for processing and review of the certified payrolls by the prime contractor. The first pay estimate can be made prior to the submission of the first certified payroll(s) assuming the contractor and/or subcontractor(s) will submit certified payrolls in a timely manner. If the contractor is working consistently on the project subsequent certified payrolls are to be submitted on a weekly basis thereafter.

For projects less than 75 calendar days in duration, the time frame for submittal is reduced to two weeks for short duration projects as discussed at the end of the section titled “Notice of Delinquent Certified Payrolls”. Certified payroll submissions not meeting the above time requirements are considered delinquent.

LCPtracker

The Labor Compliance Program Tracker (LCPtracker) herein referred to as LCPtracker is a third-party web-based solution used by MDOT to receive, review, and approve payroll and associated prevailing wage documents. Documents submitted into LCPtracker will be maintained in LCPtracker throughout the life of the contract and will comply with department retention period requirements thereafter to preserve project records.

Prevailing Wage Procedures

Contract Setup and Assignment – Setting up and assigning a contract in LCPtracker includes entering project specific information into the user interface, assigning the prime contractor, and assigning the project wage decision(s) to the contract. Projects delivered at the Transportation Service Center (TSC) level including consultant delivered contracts must be setup and assigned by the TSC. Once a project has been setup the project office must request an LCPtracker administrator assign a prime approver to the contract. This can be accomplished by sending a request to the LCPtracker resource email at: MDOT-LCPtracker@Michigan.gov.

Wage Determination Entry – Entry and maintenance of wage decisions is the responsibility of the MDOT CFS LCPtracker administrator. If at any time a project office becomes aware that a wage determination required for their project is not available, the MDOT LCPtracker administrator must be notified at MDOT-LCPtracker@Michigan.gov. Wage entry requests must allow at least two business days for the information to be input into LCPtracker.

Contract Administration – The day-to-day administration of the contract is the responsibility of the Engineer or their designee. This will include approving fringe benefit statements, receiving, reviewing, and accepting certified payroll submissions, approving apprenticeship documents, establishing project specific apprenticeship/On-the-Job Training (OJT) classification(s), and closing completed contracts.

- Reviewing and Accepting Payroll - The Engineer or their designee must closely review the certified payrolls from the prime contractor and subcontractor(s) that work on the project to ensure consistency with work performed. Once it is established that a contractor is submitting complete and accurate certified payrolls, subsequent payrolls need to be randomly checked during the remainder of the project. At any time, a more extensive payroll review must be undertaken if determined necessary by the Engineer. While the LCPtracker software provides a high level of quality assurance that the information is submitted correctly, attention must still be focused on the number of employees, classifications, and time on site. LCPtracker must be accessed to review/accept payroll at least as frequently as pay estimates are processed to ensure the required payrolls have been submitted. All certified payroll submitted on a contract must have an accept status of either reviewed or accepted. For additional information on certified payroll review see the subsection marked Certified Payroll Review.

- Apprentice/OJT Classifications – Contractors cannot submit payroll for apprentice and OJT employees unless the necessary classifications have been created for the project in LCPtracker. When a contractor becomes aware they require an apprentice or OJT classification they must submit the supporting documentation into LCPtracker under the document designation “Apprenticeship Documents”. The contractor must notify the Engineer that these documents have been uploaded and identify the appropriate apprentice/OJT percentage required. The Engineer must approve the supporting documentation, approve the employee’s apprentice status, and add the apprentice classification to the project wage data. An employer with an apprentice/OJT on the cusp of a wage increase may request multiple classifications be established to simplify the process.

- Project Closeout – Engineers that have processed the final estimate and anticipate no further prevailing wage work must change the status on the contract to closed in the LCPtracker system. Projects that are closed may be reactivated at a later date in the event more work is required by the contract. The closing of contracts maintains the integrity of the data and ensures that MDOT does not incur additional licensing fees for projects completed contracts.

- Additional users – If the determination is made at the project level that additional users are necessary to conduct business efficiently, an existing LCPtracker user may establish new user identities. When establishing new users in LCPtracker, consideration should be given as to the type of access the new user requires. Assigning a user to a TSC via the “assigned departments” dropdown will afford access to all projects currently active in the TSC and must only be given to people requiring that level of authority. A consultant performing construction engineering services on one contract must only be afforded access to that individual contract under the “assigned projects” section. Additionally, employees who depart must be removed from the list of approved users upon departure. It is the responsibility of the employer to ensure that only those who require access possess it to protect the integrity of the data. Questions regarding the addition and removal of additional users should be directed to the MDOT CFS LCPtracker administrator at MDOT-LCPtracker@Michigan.gov.

Local Agency Programs

Contracts delivered by a local agency, or consultant on behalf of a local agency will be setup and assigned by the CFS staff. Request for setup and assignment of local agency contracts must be made after the contract has been awarded and before the field work begins. Requests will be sent via email to MDOT-LCPtracker@Michigan.gov. The request must include the contract ID, identification of the prime approver, and name/email address/phone number for the office technician responsible for the contract. Once the project has been assigned it is the responsibility of the project staff to perform the contract administration as outlined above.

Training / Program Support

LCPtracker provides a host of PDF support documents accessible through the user interface. Additional support can be sought through the LCPtracker support team via telephone, email, remote access, and live chat. Contact information for LCPtracker support is located in the user interface through the “support” button in the top right corner of the screen interface. If all other options are exhausted, the MDOT CFS LCP tracker administrator should be contacted for support via email at MDOT-LCPtracker@Michigan.gov.

Delinquent Certified Payrolls

When weekly certified payrolls are delinquent as defined in the special provision for Labor Compliance, the Engineer will provide the prime contractor a first written notice of delinquent certified payrolls. The notice will be sent by email or other method which establishes the date the first notice was received by the prime contractor with a copy to any subcontractor(s) that may be involved. The region coordinator for prevailing wage compliance should be copied on the notice. The notice informs the contractor that payment for work is suspended as of the date the certified payrolls became delinquent for the work items of the offending contractor(s). When the pay estimate is generated, the statement “Items Withheld-Delinquent Payrolls” should be entered in the comments area. In addition, the notice is to state that if certified payrolls remain delinquent after 30 calendar days from receipt of the first notice, non-compliance damages will be assessed retroactive to the date the contractor received the first notice. The damages will be assessed on a calendar day basis until complete and accurate certified payrolls are submitted. The amount of non-compliance damages to be assessed is proportional to the value of the contractor’s work on the project, and a schedule of values is included in the special provision for Labor Compliance.

If the certified payrolls continue to be delinquent after 30 calendar days from receipt of the first notice to the prime contractor, the Engineer will implement the actions from the first notice. Concurrently, the Engineer will send the prime contractor a second written notice of delinquent certified payrolls by email or other method which establishes the date the second notice was received by the prime contractor, with a copy to any subcontractor(s) that may be involved. The region coordinator for prevailing wage compliance and the Construction Field Services Prevailing Wage Compliance Specialist should be provided a copy of the notice. The notice will state if the certified payrolls remain delinquent for 30 days from the receipt of the second notice, the Engineer will rescind all previous payments for work completed by the offending contractor(s). In addition, the Engineer will complete interim Contractor Performance Evaluations for the offending contractor. If certified payrolls have not been received from the contractor after 30 calendar days from receipt of the second notification, the Engineer will implement the actions from the second notice. In all circumstances, the withholding of payments, assessment of non-compliance damages, and rescinded payments will continue until all delinquent certified payrolls are current, complete, and correct.

The notification sequence previously described is as follows:

| Initiate Notice | Notice Sequence | Contractor Notice of Action | Allotted Time for Response/Resolution | If No Response/Resolution |

|---|---|---|---|---|

- Note 1: Notice will be signed by the Engineer and delivered by email or other method which establishes the date received by the prime contractor. The region coordinator for prevailing wage should be copied on the first notice to the prime contractor. The region coordinator for prevailing wage and the CFS Prevailing Wage Compliance Specialist will be copied on the second notice to the prime contractor.

- Note 2: Prior to generating an estimate on which payment is being withheld or deducted, the following statement is to be entered in the comment box: “Items withheld – Delinquent payroll.”

Certified Payroll Status Record

The Engineer will maintain a current (updated weekly) log documenting the submittal status of certified payroll for each contract. The Certified Payroll Status Record (MDOT form 1954) is available for this purpose. The record will show whether the contractor and/or subcontractor worked during the weekly period, and the date the certified payrolls were received from the prime contractor. In addition, the status record should document the date any notifications are sent to the prime contractor of delinquencies and/or deficiencies with certified payrolls, and the dates when the revised/corrected certified payrolls were received. The certified payroll must include the following information:

- The firm’s name and address with the prime or subcontractor(s) identified.

- Payroll number, week ending, project location and contract ID (contract identification).

- The employee’s full name and last four digits of their social security number.

- Employee’s gender and ethnicity.

- The employee’s classification and group number from the wage determination. (Laborer example: LABO0465-001, Group 1)

- Identification of trainees and apprentices, and program levels.

- The employees daily and weekly hours worked in each classification on the project, including overtime hours.

- The basic hourly rate, overtime rate (if applicable) and the method by which fringe benefits are paid (By checking Box(4)(a) approved programs, Box (4)(b) paid in cash, or a combination of the above methods with an explanation in Box (4)(c). If fringe benefits are paid to an approved plan, a detailed breakdown of the type of benefits and hourly dollar values must accompany the first certified payroll. In addition, plan administrator contact information must be included. If there is a change to the fringe benefits payment after submittal of the first certified payroll, the fringe benefit information must be resubmitted. This information will be used to verify the benefits being paid are “bona fide” and that the total compensation is in compliance with the prevailing wage requirements of the contract.

- The itemized deductions including the identification of other deductions where other deductions exist.

- The gross job wages paid.

- The gross weekly wages paid for all jobs. The net weekly wages paid for all jobs.

Certified Payroll Review

The Engineer will closely review the certified payrolls from the prime contractor and subcontractor(s) that work on the project. Once it is established that a contractor/subcontractor is submitting complete and accurate certified payrolls, subsequent payrolls need to be randomly checked during the remainder of the project for that contractor/subcontractor. In addition, the total combination of base wage and fringe benefit reported on the certified payroll must be at least the prevailing wage contained in the wage rate decision in the contract or applicable addendum.

The review should compare information contained in the certified payrolls with information on the Inspectors Daily Reports (IDRs), including number of workers, hours worked, type of work and equipment on the job. It is important that the information is accurately recorded on the IDR each day so the proper review can be completed on the certified payrolls. The review should verify that the appropriate work classifications are reported to support the type of work being done on the job. For example, when concrete curb and gutter is being placed on a job, there are finishers (cement masons, PLAS0514-001); laborers (form/line setters, LABO0465-001, Group 6); laborers (unskilled laborers, LABO0465-001, Group 1); and operators (if using a slipform curb machine, ENGI0324-006, Group 1). Compliance with prevailing wage requirements can only be determined once this comparison is made. Any inconsistencies are brought to the attention of the contractor.

Additional attention should be paid to:

- The overtime rate must be at least one and one-half times the base hourly rate from the wage rate decision in the contract.

- Overtime is required to be paid for hours worked in excess of 40 hours in a work week.

- Fringe benefits must be paid for all hours worked.

If two or more base hourly rates apply, then a weighted average should be used to determine the overtime rate for hours worked in excess 40 hours per week. The applicable base hourly rates will be paid for every hour worked plus a weighted average premium rate for the hours worked in excess of 40 in a week.

Contact the CFS Prevailing Wage Compliance Specialist for assistance with the determination of weighted average overtime rates.

Deficient Certified Payroll

During the review, if the weekly certified payrolls are found to be incomplete, inaccurate, or inconsistent with the other project records, they are considered deficient. The Engineer will notify the prime contractor of the deficiencies by email or other method which establishes the date the notice is received by the contractor with a copy to any subcontractor(s) that may be involved and the region coordinator for prevailing wage compliance.

The notice will inform the contractor(s) that if the deficiencies are not corrected and revised certified payrolls are not received by the Engineer in 30 calendar days from receipt of the notice by the prime contractor, payment for the offending contractor’s work items will be withheld until corrected and revised payrolls are received by the Engineer. In addition, the notice will state the intent to assess non-compliance damages retroactive to the date the prime received the first notice until all issues are resolved. The offending contractor must submit revised certified payrolls correcting all deficiencies and/or errors through the prime contractor. The amount of non-compliance damages to be assessed is proportional to the value of the contractor’s work on the project, and a schedule of values is included in the special provision for Labor Compliance.

If the issues are not resolved within 30 calendar days from the receipt of the first notice, the Engineer will implement the action from the first notice. Concurrently, they will send a second notice to the prime contractor by email or other method which establishes the date the notice was received by the contractor, with a copy to any subcontractor(s) that may be involved. The second notice will state that if corrected and revised certified payrolls are not received within 30 calendar days of the receipt of the second notice by the prime contractor, the Engineer will rescind all payments for the offending contractor’s work items previously paid. In addition, the Engineer will complete interim Contractor Performance Evaluations for the offending contractor. The CFS Prevailing Wage Compliance Specialist and region coordinator for prevailing wage compliance are also to receive a copy of the second notice.

If the deficient certified payrolls are not corrected and revised certified payrolls received by the Engineer within 30 calendar days of the second notice, the Engineer will implement the actions in the second notice and prepare the appropriate Contractor Performance Evaluations to report the continued non-compliance with prevailing wage requirements. Assessment of non-compliance damages, withholding of payments, and rescinded payments will continue until all corrected and revised certified payrolls are received by the Engineer.

The notification sequence previously described would be as follows:

| Initiate Notice | Notice Sequence | Contractor Notice of Action | Allotted Time for Response/Resolution | If No Response/Resolution |

|---|---|---|---|---|

- Note 1: Written notice will be signed by the Engineer and delivered by email or other method which establishes the date the notice was received by the prime contractor. The offending subcontractor(s) and the region coordinator for prevailing wage compliance will be copied on the email.

- Note 2: Written notice will be signed by the Engineer and delivered by email or other method which establishes the date the notice was received by the prime contractor. In addition, the offending subcontractor(s), the region coordinator for prevailing wage compliance, and the CFS Prevailing Wage Compliance Specialist will be copied on the email.

Wage Decisions

The U.S. Department of Labor is responsible to obtain and compile wage rate information through voluntary means and the completion of Davis Bacon wage surveys. This information is used to update or modify four categories of wage decision:

- Building – sheltered enclosures with walk-in access. Examples of MDOT building construction include Rest Areas and Welcome Centers.

- Residential – single family houses or apartment buildings of four stories or less.

- Highway – alteration or repair of roads, streets, highways, bridges, runways alleys, trails, paths, parking areas, and other similar projects.

- Heavy – operations or activities not conforming to any other classification will be considered heavy construction work when sizable enough to be classified independently. Examples of MDOT heavy construction work include projects with substantial sewer/watermain work or landscaping.

All MDOT let federal-aid contracts will contain at least one wage decision. Contracts involving two or more project numbers and multiple funding sources (e.g., Federal, State, other) must adhere to DBRA labor standards for the completion of the entire contract if any source is federal. Contracts funded solely by the State that contain no federal money will contain no wage decision or prevailing wage requirements.

The most prevalent wage decision used on MDOT projects is the Michigan Statewide Highway wage decision (General Decision Number: MI1).

Multiple Wage Decisions

Contracts involving elements of two or more categories of construction normally require multiple wage schedules when types of work are substantial in relation to project cost. Substantial is defined as greater than 20-percent of project cost or $1,000,000 per engineer estimate. Only one schedule will be included if construction items are “incidental” in function to the overall character of the project (e.g., a small amount of sewer repair on a large pavement reconstruction) as long as there is not a substantial amount of construction in another category. Alternate wage schedules for substantial work items are intended to provide crafts and classifications that more closely apply to the construction work type. The classifications and rates included in alternate wage decisions only apply to the work which necessitated the inclusion of the alternate decision. The remainder of the work performed on the contract is covered by the MI1 highway decision.

When sewer and/or watermain work (MDOT prequalification K) is substantial in relation to project cost a heavy decision will be included in the contract. This heavy decision provides an alternate set of crafts, classifications, and levels of compensation that must be observed when performing the sewer/watermain work. All other work on the contract will be covered by the MI1 wage schedule if no other work item was substantial enough to be classified separately (i.e., landscaping). The heavy wage schedule is most frequently included in MDOT contracts to cover sewer and/or watermain.

If landscaping work (MDOT prequalification H) is substantial in relation to project cost a heavy decision will be included in the contract documents. This heavy decision provides an alternate set of crafts, classifications, and levels of compensation that must be observed when performing landscaping work. Landscaping is generally the ornamentation or beautification of a project site through planting of shrubs, trees, and other items. Restoration of sites disturbed by roadwork is not landscaping and is not considered heavy work. If the contract is entirely landscaping, then only a heavy decision will be included in the contract documents.

When construction or rehabilitation of a building is substantial in relation to project cost a building decision will be incorporated into the contract documents. The building decision will provide crafts and classifications necessary to perform the building work (drywall hangers, roofers, glaziers, etc.). In the instance of a total rest area replacement, the contract will contain both a building decision and a MI1 highway decision. The building decision will apply to a five-foot perimeter outside of the building and the remainder of the work will be covered by the MI1.

Wage Rate Interviews

Wage rate interviews must be performed at least once for each craft (laborer, operator, carpenter, etc.) of worker employed by each contractor and/or subcontractor working on federally funded projects. Interviews must occur on-site during the course of the work. For multi-year projects, interviews must be conducted on all contractors and/or subcontractors in each season they work on the project. Projects funded entirely by the State of Michigan do not require wage rate interviews.

All contractors must permit the Engineer or their representative to interview employees during working hours on the project. The prime contractor is responsible for advising subcontractor(s) of the requirement to pay the prevailing rate prior to the commencement of the work and that all employees must cooperate during wage rate interviews.

If a language barrier is encountered, employees of the contractor or subcontractor are not to assist in language interpreting. The services of a language interpreter are available to the Engineer upon request. Instructions for over the phone interpreting services can be found on page two of the wage rate interview form. Contact the CFS Prevailing Wage Compliance Specialist for information about interpreter service.

Use the Minimum Wage Rate Interview Sheet (MDOT form 1156) to record information obtained during the wage rate interview. The form should be filled out to the extent possible prior to conducting the interview. The following procedures are to be used when conducting wage rate interviews.

- Project staff will conduct field interviews on all federal-aid projects during the course of the work.

- The MDOT Minimum Wage Rate Interview Form 1156-T1 must be completed by the Engineer or their representative.

- Wage rate interviews will be completed each season for multi-season projects.

- Interviews will be conducted with a representative sample of the work force for each contractor and subcontractor on the project during each construction season. Each classification and group must be included in the interview process. Operators of equipment and trucks whose ownership is not clearly identified should be interviewed.

- Interviews should be completed during the early part of the project to verify prevailing wage compliance. If issues are found, they must be addressed by the Engineer immediately.

- The interview will be done to ensure the privacy of the worker. Coworkers and supervisors are not allowed to be present during the interview.

- The worker must be given a standard business card with contact information in the event the interviewee would like to discuss the interview issues further, supply additional documentation or information, or to continue the interview in a more private and confidential setting. The worker may also be directed to the Fraud and Abuse Hotline poster required to be included in the jobsite postings.

The Engineer will compare the wages and the work description documented on MDOT Minimum Wage Rate Interview Form 1156-T1 with the certified payrolls, IDRs, inspector’s observations, diaries, documentation in the project files and prevailing wage compliance requirements in the contract. If inconsistencies are found (i.e., an employee is not paid prevailing wages and fringe benefits as required in the contract), the Engineer will investigate (see section In-Depth Examinations below for further guidance). The Engineer should contact the CFS Prevailing Wage Compliance Specialist and region coordinator for prevailing wage compliance to discuss the examination and any actions that may be taken as a result of the findings.

Prevailing Wage Classifications

When determining which classification applies to the work being performed on the project, it is always acceptable for the contractor to pay workers the highest rate.

- Laborer - Open Cut as listed in the Highway, Airport & Bridge and Sewer/Incidental to Highway

- Most landscaping and restoration work are not covered by the open cut laborer classifications. These laborer classifications are incorporated into the federal general wage decisions only for open cut work that is incidental to highway work. For the purposes of prevailing wage laborer classification, incidental is defined as equal to or less than 20 percent of the engineer’s estimate for the contract work. If the work is more than that amount, the contract will have multiple wage decisions. Open cut construction is work that requires the excavation of earth. Examples of MDOT open cut work are sewer, watermain, and wetland mitigation. When landscape and/or restoration is required as a result of work associated with an incidental amount of open cut work (i.e., 20 percent or less), then Open Cut Laborer Group 7 would apply only to that portion of landscaping or restoration associated with the open cut activities. If the landscaping and/or restoration work is not related to the open cut work, then the Open Cut Laborer Group 7 rates do not apply. The correct classification is Highway Laborer Group 1 for miscellaneous or unskilled laborer. This does not include hazardous waste abatement, tunnel, shaft and caisson, or open cut construction.

- Video Taping

- If the work is only internal sewer inspection by videotaping then prevailing wage does not apply. However, when the internal inspection of sewer lines for leakage and damage through the use of video inspection and simultaneous repair and/or cleaning is involved, the operation of the video equipment is covered.

- Pavement Sweeping

- When pavement sweeping is a requirement of the contract, it is covered by prevailing wages. Group 2 under the power equipment operators for airport, bridge and highway construction classifications is appropriate for the operator of the sweeper truck.

Supervisors and Working Foremen

Supervisory and managerial personnel are generally not covered by DBRA. Working foremen who perform the work of a laborer or mechanic on the job may be subject to prevailing wage requirements. On projects covered by DBRA, if the supervisor or working foreman devotes more than an incidental amount of time (20-percent) during a work week to laborer or mechanic duties, they are considered to be laborers or mechanics for the time spent performing those duties and are subject to prevailing wage requirements. Supervisors and working foreman who are subject to prevailing wage must be shown on a certified payroll and must meet or exceed the total prevailing wage requirement for the craft and classification they’re working under (i.e. laborer, operator, electrician, etc.).

Product and Material Supply Personnel

The manufacture and delivery to the work site of supply items such as sand, gravel, asphalt, and ready-mixed concrete, when accomplished by bona fide material suppliers operating facilities serving the public in general, are not activities covered by DBRA. Such bona fide materials suppliers are not considered contractors under DBRA, and their employees are not subject to DBRA labor standards. If a material supplier or manufacturer undertakes to perform a part of a construction contract as a contractor or subcontractor, then its laborers and mechanics employed at the site of work are subject to DBRA in the same manner as those employed by any other contractor or subcontractor.

Traffic control device companies which rent equipment to the prime contractor and perform only incidental functions at the site of work in connection with delivery of equipment are generally regarded as material suppliers. Employees of these companies are only subject to DBRA labor standards if their employees spend a substantial amount of time (20-percent or more) in the work week on the site of work. This 20-percent evaluation applies to an individual contract in any given work week and is not cumulative over all DBRA covered projects they may work on. Traffic control device companies who undertake contract work as a subcontractor (e.g. driving temporary signs, setting up closures, etc.) are covered by DBRA.

Examples of when DBRA coverage is required:

- Installing driven/fixed signs, barrels, and barricades on the site of work in accordance with the requirements of the contract (including initial placement).

- Providing traffic regulator control.

- Placing temporary/portable signs at other locations on the site of work (excluding initial placement).

Examples when DBRA coverage is not required:

- Drop off and pick up of traffic control products on the site of work when this time is de minimis.

- Maintaining/servicing temporary signs, barricades, etc., when this time is de minimis.

- Drop off and pick up of traffic control products at contractor’s yard outside the site of work.

- Travel between DBRA-covered projects.

Post Tensioning of Concrete Beams at Site of Work

The USDOL regulatory definition (See 29 CFR 5.2) of “construction” includes “manufacturing or furnishing of materials, articles, supplies or equipment on the site of the . . . work . . . .” as well as the installation of items fabricated off site. For example, employees of a materials supplier who are required to perform more than an incidental amount of construction work in any work week at the site of the work would be covered by DBRA and due the applicable wage rate for the classification of work performed.

For enforcement purposes, the USDOL adopts a policy that if such an employee spends more than 20 percent of his/her time in a work week engaged in the work of a laborer or mechanic on the site of work, he/she is subject to DBRA coverage for all time spent on the site during the work week. DBRA coverage does not apply to factory representatives who simply observe and monitor the post tensioning activities.

Truck Drivers

Prevailing wage coverage for truck drivers varies based on the nature of their operations on the project and duration spent performing their operations.

- Truck drivers are covered by DBRA while:

- They are working on the “site of work.”

- Hauling to or from a facility that is deemed part of the “site of work.” (For example, driving between the job site and a dedicated batch plant or tool yard located adjacent to, or virtually adjacent to, the job site).

- Truck drivers are not covered by DBRA in the following instances:

- If the driver is not working exclusively on the site of work. To be covered by DBRA, the time spent working on site must be more than de minimis (20 percent or more of the work week).

- Examples when a truck driver is not covered by DBRA include, but are not limited to, the following:

- While off the “site of work.” The transportation of materials supplies, tools, equipment, etc., from one site of work to another is not covered unless such sites are dedicated and adjacent.

- While loading and/or unloading materials and supplies on the “site of work.” As a practical matter, since the majority of time spent by material delivery truck drivers is off site beyond the scope of DBRA coverage and the time spent on site is relatively brief, MDOT chooses to use a rule of reason and will assume that some activities will never exceed de minimis. These items include, but are not limited to:

- Trucks delivering materials to a stockpile.

- Trucks delivering materials along the jobsite for later installation (i.e. concrete pipe, traffic control devices, etc.).

- Drivers traveling between a DBRA project and a commercial supply facility, while they are off the “site of work.”

- The travel time between two DBRA projects. The one exception to this rule is when there are adjacent projects under the same or different contracts that were established to accomplish the same objective (60 miles of resurfacing may be broken into several contracts), then all of these projects are considered contiguous and travel between sites is covered by DBRA.

Owner-Operator Trucking

Bona fide owner-operators of trucks who own and drive their own truck and operate the truck on the “site of work” are not covered under DBRA. However, the contractor who hires the owner-operator must include the names of such owner-operators on their certified payrolls, but do not need to show the hours worked or rates paid, only the notation “owner-operator.” (Note: This applies only to the individual owner of a truck. The same policy does not apply to owner-operators of other equipment such as bulldozers, backhoes, cranes, welding machines, etc.)

In-Depth Examination

When an apparent prevailing wage compliance violation arises, and an in-depth examination of the certified payroll records becomes necessary, the Engineer will contact the region coordinator for prevailing wage compliance for guidance and assistance. It is imperative that during any examination the identity and privacy of all individuals be protected. DBRA regulations require strict confidentiality for individuals. All discussions and communications with contractors and others must be general and all-encompassing so individuals cannot be singled out. Examinations may be required due to several reasons including, but not limited to, the following:

- Wage rate interview issues

- Employee complaint

- Certified payroll discrepancies

- Fraud and Abuse Hot Line calls

- Laborer’s Council requests

- Contractor requests

- Inspector observations

- Audit findings

- Interim project reviews

- Other issues.

Depending on the nature of the issue, several avenues may be pursued. Examinations should consider, but are not limited to, the following:

- Information in the project files which may include IDRs, certified payrolls, payroll status records, wage rate interviews, diaries, force account records, delivery tickets, progress reports or other sources from the files and other readily available project information.

- Interviews with present and former employees of the contractor.

- Documentation from employees such as timecards, work logs, and check stubs.

- Information from the contractor or subcontractor(s).

The examination may require detailed observation of the contractor’s activity on the job and documenting the number of workers, hours on the project and equipment in use. It is important that any information gathered and used in any examination be factual and accurate, as it may have to withstand the scrutiny of a court proceeding. The information from these and any other sources should be reviewed and analyzed to either support the existence of a violation, that no violation has occurred, or that there is not enough evidence to make a determination and further investigation is needed.

When it is determined that an investigation will need to go beyond what is readily available to the Engineer in the project files and other sources, the CFS Prevailing Wage Compliance Specialist is to be contacted. The situation will be reviewed, and a determination made whether to pursue the issue further or turn it over to others to perform the investigation.

Restitution

If the Engineer and the region coordinator for prevailing wage compliance determine there are prevailing wage violations and restitution is required, the CFS Prevailing Wage Compliance Specialist is to be notified. If possible, the amount of restitution will be determined. The Engineer will send the first notice to the prime contractor and any involved subcontractors of the violation and restitution amount, if known, by email or other method which establishes the date the notice is received by the prime contractor. The first notice will inform the contractor(s) that the Engineer is immediately withholding the amount of the violation, if known, or an estimated amount and that if the violation is not fully resolved in 60 calendar days from the receipt of the first notice, the intent to withhold payment for the offending contractor’s items. The Engineer and the contractor can mutually agree in writing to extend this 60-day requirement.

If the violation is not fully resolved within 60 calendar days from the receipt of the first notice or the mutually agreed upon extension, the Engineer will implement the actions from the first notice. Concurrently, the Engineer will send a second notice to the prime contractor and involved subcontractor(s) stating that if the violations are not fully resolved within 30 calendar days of the receipt of the second notice, non-compliance damages will be assessed retroactive to the date of the first notice, and the contractor will be responsible for any and all costs associated with the investigation and audit expenses accrued by MDOT and associated entities in dealing with the violation. The notice will also state that the assessment of non-compliance damages will continue to be assessed until the date the violation is fully resolved and proof of payment in the form of cancelled checks or other form of acceptable proof is provided to the Engineer.

If the violation is not fully resolved within 30 calendar days of the receipt of the second notice, the Engineer will implement the actions from the second notice and prepare interim Contractor Performance Evaluations reflecting the non-compliance activity of the offending contractor(s) and lack of attentiveness by the prime if the offending contractor(s) are subcontractor(s).

A copy of all correspondence dealing with prevailing wage violations will be sent to the CFS Prevailing Wage Compliance Specialist and region coordinator for prevailing wage compliance. In addition, any extension of the 60-day requirement will be discussed with the CFS Prevailing Wage Compliance Specialist and region coordinator for prevailing wage compliance.

The Engineer will require the contractor to revise certified payrolls and provide canceled checks or other form of proof deemed acceptable by the Engineer illustrating restitution was made. If the violation involves a subcontractor, the Engineer and region coordinator for prevailing wage compliance will work through the prime contractor to assure that restitution was made. Once restitution has been made, the Engineer will report the amount and number of employees involved to the region coordinator for inclusion in the Semiannual Compliance Enforcement Report. On local agency projects, the Local Agency Engineer will report the same data to the Engineer at the TSC for inclusion in their report to the region coordinator.

Post-Construction

When prevailing wage violations become apparent after the final estimate has been processed, the contractor will be notified of the violation(s) by email with a copy to the CFS Prevailing Wage Compliance Specialist and the region coordinator for prevailing wage compliance. If the violation involves a subcontractor, a copy of email will be sent to the subcontractor. The letter will give notice that if the issue is not resolved within 60 calendar days from contractor receipt of the notification, a post final negative estimate will be generated rescinding payment in the amount required for restitution for the violation from the work items of the contractor found to be in violation.

Contractor Performance Evaluation (CPE)

When a contractor or subcontractor(s) is found to be in non-compliance with DBRA requirements and fails to take the necessary actions to become compliant, the Engineer will document the non-compliance through the CPE process. During the project, when issues are found and there is a lack of cooperation from a contractor or subcontractor, an interim evaluation will be submitted. Providing documented feedback to the contractor via a CPE can aid in the compliance process. An interim CPE should be processed timely to notify the contractor of poor performance and should not be done for prevailing wage related matters if no additional work will be performed by the contractor.

Prevailing Wage Oversight Quality Assurance

In order to ensure compliance with MDOT prevailing wage oversight procedures, Quality Assurance (QA) reviews will be conducted at all levels of prevailing wage oversight for MDOT let contracts. Reviewers must complete the Prevailing Wage Quality Assurance Review Checklist MDOT Form 1965.

The following process will be followed at all levels of oversight.

- In order to identify any problems with prevailing wage compliance, the QA reviews will be conducted each construction season while the contract is active.

- A sufficient number of contractors assigned to the contract will be reviewed to assure compliance with prevailing wage requirements.

- Certified payrolls and other project documentation will be reviewed to determine compliance.

- If deficiencies are discovered during the review, follow-up and document the resolution.

- When deficiencies are found, the proper procedures will be reviewed with the Engineer.

During the review, the following prevailing wage compliance procedure requirements are to be checked:

- All posters and jobsite information must be posted, as required.

- Wage rate interviews are conducted according to the prevailing wage procedures.

- The certified payrolls are complete and consistent with other project documentation.

- Workers were paid the correct wage.

Local Agency Level

- The region coordinator for prevailing wage compliance will work with the local agency designated representatives at each TSC to ensure that a QA review is done for a minimum of one contract for each local agency under the jurisdiction of the TSC. Additional reviews may be needed if noncompliance is discovered.

- Once the review is complete, the engineer will forward a copy of the review documents to the region coordinator.

- The region coordinator will review the documents to assure compliance with MDOT procedures and forward a copy to the CFS Prevailing Wage Compliance Specialist.

TSC Level

- The region coordinator for prevailing wage compliance will conduct random QA reviews for each Engineer in each TSC in their region.

- The region coordinator will select a minimum of 10 percent of TSC projects for review. If the TSC has less than ten projects in a construction season, then at least one project will be reviewed. Additional reviews may be needed if noncompliance is discovered.

- Once the review is competed the coordinator will forward a copy of the review documents to the CFS Division Prevailing Wage Compliance Specialist.

State-Wide Level

The CFS Prevailing Wage Compliance Specialist assures compliance of the prevailing wage oversight program statewide. The following process will be used:

- Review reports from region coordinator for prevailing wage to assure oversight compliance at the TSC and local agency level.

- Select a minimum of one contract from each region for QA review of prevailing wage compliance.

Additional Information

Sample notification letters are intended to be used as a tool to achieve compliance with the prevailing wage provisions of the contract. It is strongly recommended that the sample notification letters below be used to communicate noncompliance discovered on the contract to ensure clear, concise, and consistent communication between the contracting agency and the contractor.

Annual Prevailing Wage Training

For a list of Region Coordinators and other Prevailing Wage information, please visit the Prevailing Wage Compliance site.